Executive Summary

A GL account is separate from a cost code financial and job cost reporting. Here we introduce the basics of GL accounts

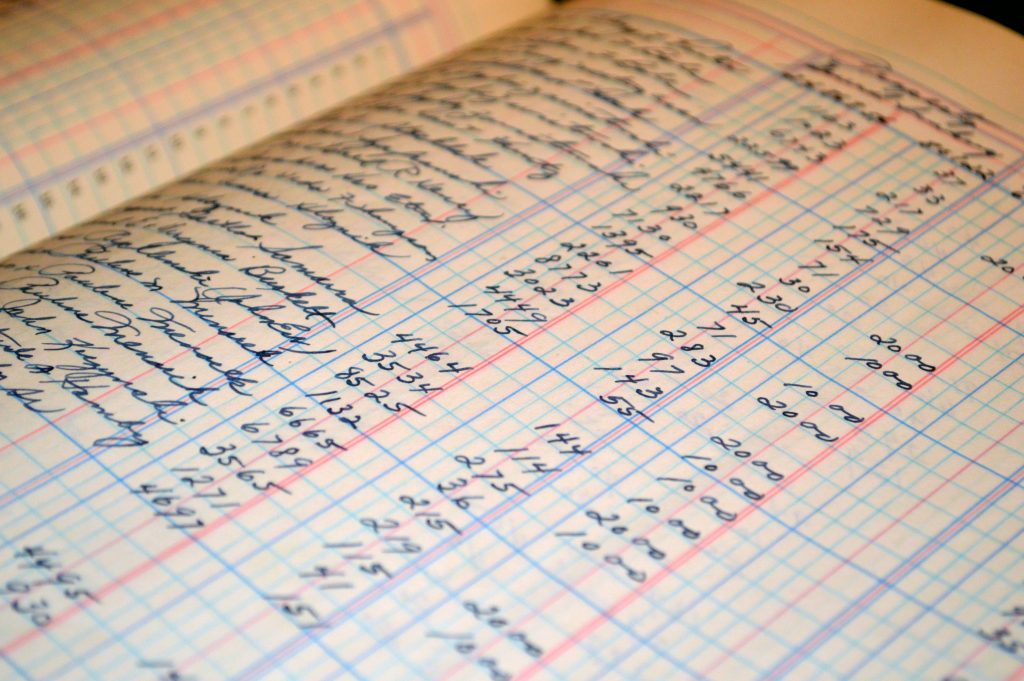

What’s a GL Account?

GL stands for General Ledger. The general ledger is a set of accounts used by your accountant to classify costs within your company across your financial statements.

The two main financial reports used to judge the health of your company are the income statement and the balance sheet. These reports are generated based upon the reporting of costs you make.

Most often GL accounts are four digits. The families of GL accounts and their corresponding financial report follow:

1000s Assets Balance Sheet

2000s Liabilities Balance Sheet

3000s Equity Balance Sheet

4000s Revenue Income Statement

5000s Cost of Goods Sold Income Statement

6000s/7000s Operating Expenses Income Statement

8000s/9000s Other income/expenses Income Statement

These accounts are different from cost codes. Cost codes are used more specifically for job costs.

My Story

In my travels I see many companies using GL accounts to report their job costs. This method does not allow enough specificity into reporting the wins and losses on an activity by activity basis. GL accounting across an entire business will give a job profit and loss statement, but you’ll never know in what aspects of the job you’re making or losing money!

0 Comments