Executive Summary. Construction businesses are bought and sold every day. If you’re looking to sell your company, here are the basics on what you need to know (and what you want to know).

What can my business sell for? Let’s be honest, this is really the only reason you’ve read this far in the article. You want the magic formula. Well, I don’t have it. And it doesn’t exist. It’s like bonding; it is based on the numbers, but so many other variables come into play too.

I heard it’s based on EBITDA. EBITDA is defined as earnings before interest, taxes, depreciation, and amortization. It can be calculated by your bookkeeper or CPA using your simple financial statements. You can actually calculate it yourself with a little help from youtube.com.

But here’s the problem – after you get this EBITDA value (which is an amount of money), you then have to multiply it by a factor. To get a factor, I went to two websites in the last five minutes and one website said the factor is 9x to 11x, and the other site said 2.5x to 4.5x (2.5x means “2.5 times”). So, the answer really is that your company is worth whatever someone will pay for it. But, there are things that you can do to increase the value.

There are other calculation methods too like Net Asset Value and Discounted Cash Flow. This, too, parallels the bonding capacity calculation as some sureties use a Net Worth calculation instead of Working Capital calculation.

So, how do I start the process? If you’re asking “how to I find someone to buy my company”, I’d say here are my three best answers (in order of ease): (1) go down the street and see if your competitor wants to buy you, (2) hire a lawyer and sell it to your employees, and (3) go find a merger and acquisition company to put you out to market. Actually now that I read it again, likely the hardest one of the three is #2 – employees are more emotional than business to business sales.

What will this cost me? When I was in the process 15 years ago with my construction company it cost about $45,000 to get the M+A firm to scrub my financials and create a deck. It’ likely doubled or tripled by now, so call that $125,000. Upon sale of the company, the M+A group will take a piece of the sale, call that 5%. Then you have costs associated with your CPA and your attorney to make this whole thing happen. And don’t forget that you’ll have your eye off the ball, so maybe you miss bidding a job or two.

I’m not ready, but want to work in that direction. If you’re thinking about selling one day, I’d suggest that you concentrate on the following:

- Have clean and timely books– make sure your bookkeeper is timely and keeping clean books. Close your books monthly. Do an over the shoulder with your CPA two to four times a year.

- Vary your clients– don’t have too many eggs in one basket. Vary your clients and markets. Is your work residential, commercial, industrial, public, private? The valuation of your business will depend on the current state of the market(s) you’re in.

- Improve your technology– are you using the latest and greatest tools and working efficiently? Some construction companies are still in medieval times. You ought not to be.

- Management team – do you have systems and processes in place that help run the company? This is good. Without you can the company function? This is not good.

How long does it take? Well, if you have a sellable company, I’ve seen it done in 45 calendar days. Probably a more reasonable period of time, assuming that there’s interest in your firm, is six months.

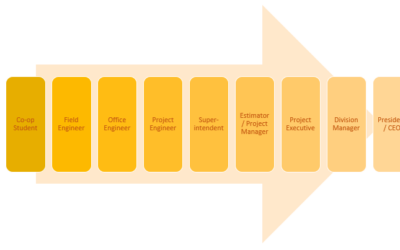

My story. My company now informally helps with the sale of companies. I play “matchmaker” to company buyers and sellers, and to employee candidates and companies hiring. It’s just a networking thing for us at SJCC.

But, I did go through this process several years ago. It was a pretty easy process, frankly. But not cheap.

Work safe!

0 Comments